For any business, managing costs is an integral part of ensuring they maintain a smooth cash flow and can successfully operate. Overheads are a crucial part of business and most cannot be avoided. However, how about those overheads that are considered to be an investment for any business? These are overheads that businesses spend out on in order to enhance their profits while increasing customer numbers. You might consider premises or a website to be an overhead that is an investment but how about a POS system?

The reality is that a business is not going to succeed if it cannot take payments from customers. With customers expecting more and more, it is now important for business owners to increase convenience and provide effective ways for them to pay. If a customer cannot make a payment or faces challenges with paying then they are going to try elsewhere and that is a given.

So, what businesses have to consider is their chosen payment systems and how they complement the running of the business. With a range of POS systems to choose from, it can prove challenging to find the right one. There are many things to consider and this comes down to functionality, flexibility and price, all of which play a significant role in determining what works and what doesn’t.

Why Does Cost Play a Part When Choosing a POS System?

Cost is always a deciding factor in any decision a business makes. Driving costs down can increase profits and that’s why the cost is so crucial. Despite this, it’s important to weigh up what you want to pay with what your EPOS till system can do. Opt for a lower price and you’ll discover that you don’t have access to the features you need. Pay too much and you might find that you are paying for features that you don’t need or use.

So, naturally, you are going to do your research because that’s one of the first rules of searching for cash tills that come at a monthly cost or come with no monthly cost at all. The research will help you determine which point of sales systems support your business needs in every possible way. Sure, it’s possible to save money and reduce expenses by choosing systems that offer some functionalities but then taking advantage of hardware that comes at a cost that helps you to make savings. All of this will contribute to the final cost.

You’ll find that there are many different companies out there and they all offer something different but with XEPOS, you’ll notice that payment options are readily available and with a wealth of choices, you can find something that fits your price range.

What Costs are Involved?

When purchasing a POS system, there are several costs that feed into the overall price you pay, regardless of whether that is monthly or all at once. The entire system is made up of several elements and choosing what works could be determined by your industry, your budget and many other factors.

Hardware

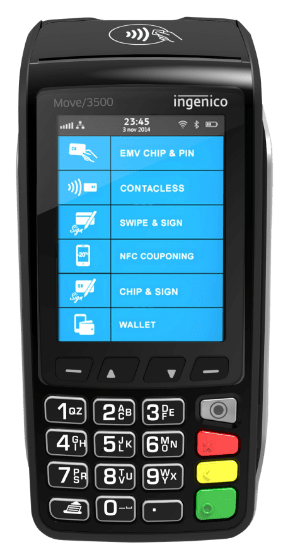

The hardware is the machine that you will use during the point of sale and this can include your EPOS till system. So, when considering your monthly or overall cost, this will need to be one of the key considerations.

The hardware will commonly include an electronic cash register, barcode scanner, receipt printer, debit and credit card machines as well as a touch screen tills. There are other pieces of hardware that can be used but on the whole, these are the basic options. So, it’s important to consider prices across the board and determine whether your financial position allows you to take advantage of no monthly costs or whether you need a monthly cost to free up capital.

Component Costs

The overall cost will again be influenced by components and this can include the cost of barcodes and secure cash drawers. Furthermore, credit card readers can also add to the cost but you’re going to need one so this is a cost that is going to be added to the overall price you pay.

Software Costs

The software will be the driving force behind what your systems do as it brings everything together. Whether it’s checking stock, ordering stock or gathering client details, it’s a crucial element. Despite this, it will reflect the needs of your business and some software is better than others but XEPOS offers software that offers exceptional levels of functionality and reliability, both of which are key to helping your business thrive. Sure, you can opt for lesser quality options but you will pay the price and find yourself eventually having to pay more for something that works.

Will You Need to Pay a Monthly Fee?

Having carried out your research, you would have found that the majority of providers will charge some form of monthly fee. Of course, they want to tie you into regular payments where you are committed and in some cases contracted and that can prove troublesome for businesses.

It’s common for new businesses to take advantage of monthly payments and XEPOS does offer monthly payments that start from as little as £25. This is a great option for businesses that want to avoid paying the initial cost in order to get started quickly and free up capital that it needs. Monthly payments are transparent, simple and easy to manage, giving businesses the ability to manage their cash flow.

However, what about those businesses that are looking to avoid monthly payments?

XEPOS has you covered!

It’s possible to take advantage of our systems without any monthly fees. We don’t feel the need to charge exceptionally high fees because we believe in providing the flexibility that works for every business.

So, it’s possible for businesses to take advantage of paying for their systems in one payment, leaving them free to focus on their business each month without having to worry about making regular payments.