Taxis have traditionally been a popular, reliable and safe mode of convenient transport for decades. Taxis are usually sourced by calling a local cab firm, ordering a cab and then paying cash when you arrive at your destination. However, in recent years we’ve changed the way we order and pay for taxis – this is thanks to technological advancements like card machines for small businesses and the majority of people having some sort of digital footprint. So, how exactly has the taxi industry changed? And, why is it changing so quickly?

It’s a Growing Trend

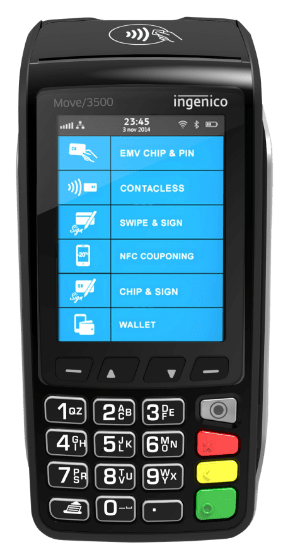

For years, cabs have been paid for in cash at the end of each journey but that has altered in recent years. Some taxi companies now offer their customers the opportunity to pay by card for their cab. For example, the Uber app allows customers to set up their bank details to their account. Their fare is then automatically taken out of their bank after every trip. Another example of this is the traditional Hackney Carriage. Many of these cabs that are driven around London now have a black cab credit card machine installed in them. It’s more convenient for people to pay in this way as they only have to carry one card around with them. Using a 3g card machine or 4g card machine allows people to keep track of their finances more easily. Another reason why paying by card machine for taxi drivers is becoming more popular is that it is safer.

It’s About Safety

The competition between local cab firms doesn't really exist in the modern-day. This is because there are now national cab companies that are available online 24/7 and have fleets of cars with merchant terminals. Appreciating the payment and digitalisation issues discussed above – makes you realise how there’s more competition. For example, Uber can offer many safety measures such as customers rating their drivers at the end of each journey. It also allows other people to track your car journey and for the driver to be more secure as they do not have to carry cash on their person and risk being targeted for robbery.

It’s Time to Adapt

So, how do local cab firms compete with these new changes? Well, if you’re reputable and well-known in your local area you’ll always have business but it will increase revenue if your firm can be card terminal providers. The reputation of local taxi firms is what keeps them in business. And, if you can adapt your business plan to meet the needs of customers and invest in a booking app and card payments you’ll soon establish yourself in the modern taxi market. Ways of standing out amongst the competition may be to purchase one of the top 10 card machines for your business so you know it will be a reliable product and serve you well. If this could include a payment processor UK option for customers to link a card to a cash plus account then it would be a valuable addition compared to competitors without this.

It’s now more important than ever before for taxi companies to future-proof their business by opting to implement card payment systems as this is now the way that customers are expecting to pay.